War hasn't stopped them. How much are multinationals earning in Russia?

In March 2022, a month after Russia's full-scale invasion of Ukraine started, Ekonomichna Pravda compiled a list of the 50 largest foreign corporations doing business in the Russian Federation and estimated the amount of tax they were paying into the aggressor country's coffers.

Those companies were found to have earned US$130 billion in revenues (based on 2021 financial statements). During that year, they had paid US$20 billion in taxes to Russia's treasury – over 40% of which was contributed by the tobacco giants.

During the two years that the war has raged on, many foreign businesses have vowed to leave Russia, while others have refused to do so. Ekonomichna Pravda has analysed the 2023 reports of some multinational companies to assess how their operations have changed over this time.

Obtaining all the data on the businesses that have remained in Russia proved to be challenging. The problem is that some of the companies that have refused to leave the Russian market have stopped releasing financial statements. The Russian authorities have granted them this right. For example, there has been no data on the revenues of Nestlé, Leroy Merlin, Mondelez or Raiffeisen Bank for two years. There are only reports of "higher than ever" profits.

It would be reasonable to assume that the multinationals’ revenues did not fall during this period, remaining at pre-war levels. Actually, the revenues of the 50 largest foreign companies that Ekonomichna Pravda researched in 2022 fell by a third in 2023 compared to 2021, to US$89 billion.

The reason for the decline is that 20 of the companies that were on this list two years ago have sold or disposed of their Russian assets, and 10 are winding down their operations in Russia. According to the KSE Institute's Leave Russia project, Renault, Toyota, Volkswagen, IKEA and McDonald's have sold off their assets in Russia.

The Western businesses’ new owners – who are mostly Russian oligarchs or Chinese businesspeople – are trying to relaunch production. Sometimes they succeed in doing so. For example, two years ago McDonald's was sold to the Russians, who immediately renamed it Vkusno i tochka (which literally means "Tasty & that's it"). Vkusno i tochka has almost doubled its revenue, although this was due to its acquisition of other assets.

In most cases, however, everything the Russians touch ends in disaster. The Russian factories of French car company Renault, which have been run by Russian state-owned corporations since 2022, have seen income plummet by up to ten times.

The same is true of other car manufacturers. Their relaunches have failed, which is why the Russian market has gradually been taken over by Chinese companies (Cherry and Haval have grown sales in Russia by 900% and 570% respectively). Chinese companies are now taking full advantage of this and are constantly pushing prices up.

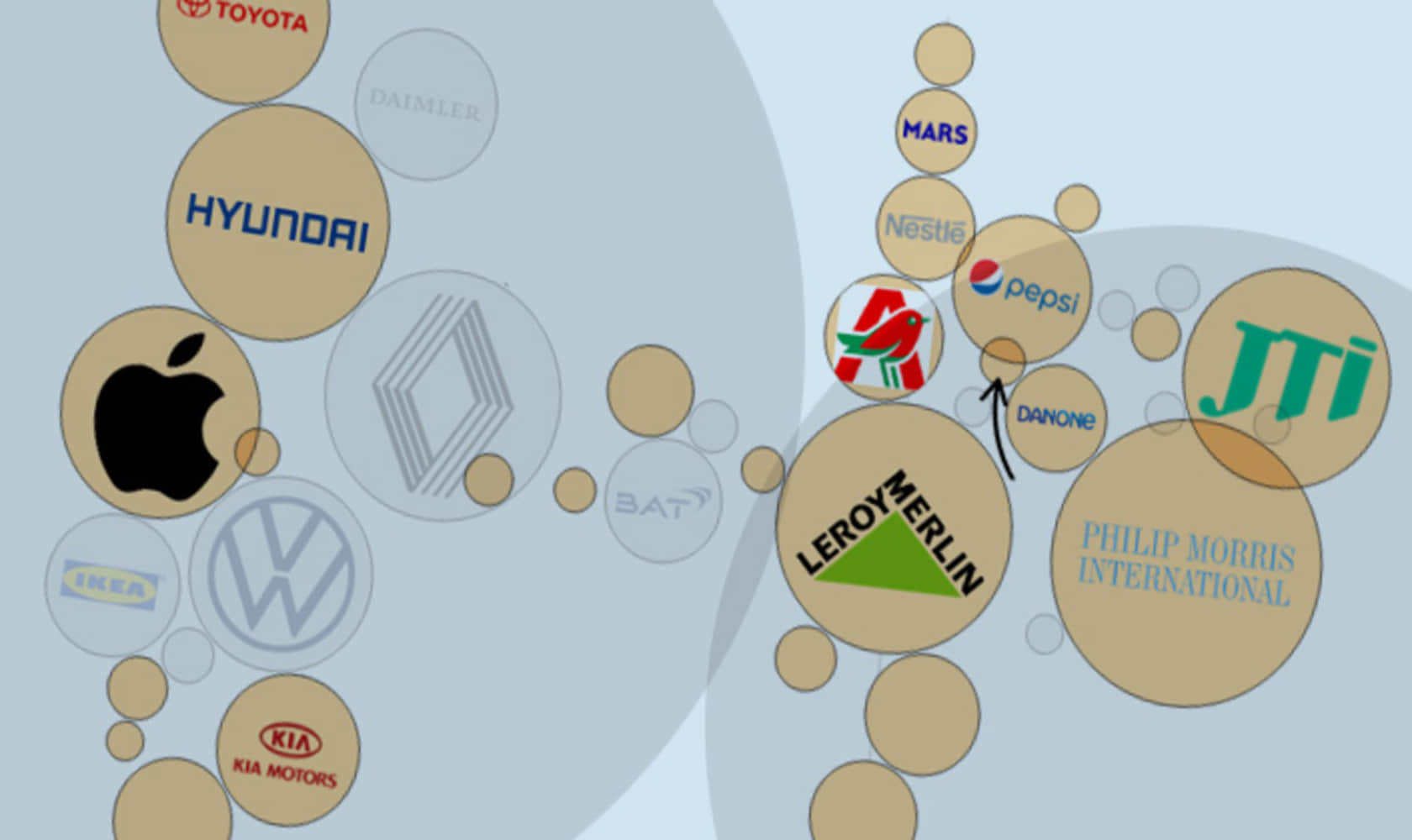

Chart:

20 companies have either disposed of their assets or sold them to new Russian owners since the start of the full-scale invasion.

In 2023, Pepsi – which has a long history of operating in autocratic countries – became the largest foreign food company in Russia.

Revenue in 2023 compared to 2021

Company: Scania

Revenue in 2021: $1,026 million

Revenue in 2023: $32 million

Company: Toyota

Revenue in 2021: $4,611 million

Revenue in 2023: $89 million

Company: Daimler

Revenue in 2021: $3,817 million

Revenue in 2023: $396 million

Company: Hyundai

Revenue in 2021: $5,990 million

Revenue in 2023: $285 million

Company: Renault

Revenue in 2021: $6,338 million

Revenue in 2023: $822 million

Company: Apple

Revenue in 2021: $5,361 million

Revenue in 2023: $50 million

Company: Volkswagen

Revenue in 2021: $4,928 million

Revenue in 2023: $353 million

Company: IKEA

Revenue in 2021: $3,611 million

Revenue in 2023: $0

Company: KIA Motors

Revenue in 2021: $3,839 million

Revenue in 2023: $331 million

Company: Nissan

Revenue in 2021: $1,392 million

Revenue in 2023: $51 million

Company: Mazda

Revenue in 2021: $1,606 million

Revenue in 2023: $28 million

Company: H&M (Hennes and Mauritz)

Revenue in 2021: $994 million

Revenue in 2023: $15 million

Company: BMW

Revenue in 2021: $3,188 million

Revenue in 2023: $131 million

Company: Komatsu

Revenue in 2021: $1,401 million

Revenue in 2023: $378 million

Company: LG Electronics

Revenue in 2021: $1,664 million

Revenue in 2023: $513 million

Company: Daimler Truck

Revenue in 2021: $1,650 million

Revenue in 2023: $561 million

Company: Samsung

Revenue in 2021: $4,975 million

Revenue in 2023: $2,051 million

Company: Shell

Revenue in 2021: $1,869 million

Revenue in 2023: $879 million

Company: Unilever

Revenue in 2021: $1,194 million

Revenue in 2023: $861 million

Company: Hellenic Bottling Company

Revenue in 2021: $1,306 million

Revenue in 2023: $1,074 million

Company: Johnson & Johnson

Revenue in 2021: $1,113 million

Revenue in 2023: $957 million

Company: British American Tobacco

Revenue in 2021: $3,131 million

Revenue in 2023: $2,814 million

Company: Procter & Gamble

Revenue in 2021: $2,313 million

Revenue in 2023: $2,054 million

Company: Henkel

Revenue in 2021: $1,321 million

Revenue in 2023: $1,211 million

Company: Fortum

Revenue in 2021: $1,146 million

Revenue in 2023: $1,078 million

Company: Huawei

Revenue in 2021: $1,567 million

Revenue in 2023: $1,567 million

Company: Mars

Revenue in 2021: $2,160 million

Revenue in 2023: $2,160 million

Company: Nestlé

Revenue in 2021: $2,633 million

Revenue in 2023: $2,633 million

Company: Auchan

Revenue in 2021: $3,181 million

Revenue in 2023: $3,139 million

Company: Leroy Merlin

Revenue in 2021: $6,342 million

Revenue in 2023: $6,342 million

Company: Cargill

Revenue in 2021: $,1636 million

Revenue in 2023: $1,583 million

Company: Metro AG

Revenue in 2021: $3,072 million

Revenue in 2023: $3,136 million

Company: OSTC Group

Revenue in 2021: $2,883 million

Revenue in 2023: $2,883 million

Company: International Paper

Revenue in 2021: $2,504 million

Revenue in 2023: $2,568 million

Company: Alphabet

Revenue in 2021: $1,865 million

Revenue in 2023: $1,865 million

Company: Arconic

Revenue in 2021: $1,018 million

Revenue in 2023: $1,018 million

Company: Imperial Brands

Revenue in 2021: $971 million

Revenue in 2023: $999 million

Company: Bayer

Revenue in 2021: $1,200 million

Revenue in 2023: $1,247 million

Company: Danone

Revenue in 2021: $2,708 million

Revenue in 2023: $2,885 million

Company: Philip Morris

Revenue in 2021: $7,275 million

Revenue in 2023: $8,207 million

Company: Mondi Group

Revenue in 2021: $992 million

Revenue in 2023: $1,061 million

Company: Glencore

Revenue in 2021: $971 million

Revenue in 2023: $1,125 million

Company: Pepsi

Revenue in 2021: $3,731 million

Revenue in 2023: $4,696 million

Company: Anheuser-Busch

Revenue in 2021: $1,186 million

Revenue in 2023: $1,508 million

Company: HAVI

Revenue in 2021: $975 million

Revenue in 2023: $1,268 million

Company: Uniper SE

Revenue in 2021: $1,307 million

Revenue in 2023: $1,725 million

Company: Carlsberg Group

Revenue in 2021: $1,147 million

Revenue in 2023: $1,518 million

Company: Elko Group

Revenue in 2021: $1,050 million

Revenue in 2023: $1,400 million

Company: Japan Tobacco International

Revenue in 2021: $5,569 million

Revenue in 2023: $7,683 million

For some companies that have not released financial statements since the start of the full-scale invasion (Nestlé, Leroy Merlin), the figures for 2023 are based on the latest available data for 2021. Mars’ latest reports were for 2022, so the data for that year is shown. The chart does not include the former McDonald's asset in Russia. After it was sold in 2022, its local company was renamed Vkusno i tochka, and in 2023 it almost doubled its revenue by reorganising and merging the assets of its new Russian owners.

Several other companies that had been undecided about staying in Russia have had their assets seized by the Russian authorities. Kremlin leader Vladimir Putin transferred foreigners' stakes in the local subsidiaries of Danone and Carlsberg to Russia's Federal Property Management Agency. The new CEO of Danone Russia is Ibragim (Yakub) Zakriev, Deputy Prime Minister and Agriculture Minister of Chechnya – and Chechen leader Ramzan Kadyrov’s nephew. [The Chechen Republic, also known as Chechnya, is a federal subject of the Russian Federation; the Ukrainian parliament has recognised it as the temporarily Russian-occupied territory of the Chechen Republic of Ichkeria – ed.]

However, about 20 corporations are still operating in Russia without the slightest sign of remorse, hiding behind the excuses of "We provide essential goods" and "We’ve cut back our investment". The reason why they continue to sponsor the Kremlin is eloquently demonstrated by PepsiCo. The company has released its 2023 accounts and revealed that its profits in Russia "are the biggest since the Soviet era".

PepsiCo's subsidiary in Russia, Wimm-Bill-Dann, has seen profits increase 2.6 times. The group's total sales, including soft drinks, dairy products, baby food, crisps and snacks, have risen by 26% to US$4.7 billion.

In fact, PepsiCo seems to be gaining momentum in the Russian market: in 2024, the American company launched the first line of a new snack plant near Novosibirsk.

Yet it's the tobacco giants that truly fill the Russian coffers with cash. Only two of the four major tobacco companies have completed their withdrawal from Russia: British American Tobacco and Imperial Brands. By contrast, the US’s Phillip Morris – the largest multinational in Russia in 2021 – has increased sales by 13%, and another tobacco giant, Japan Tobacco International, by 40%.

Dana Hordiichuk (Ekonomichna Pravda) and the Weekly Chart project

Translation: Artem Yakymyshyn

Editing: Teresa Pearce