Sky-high prices and petrol shortages: what's causing the Russian fuel crisis?

Russians are having to queue for fuel as, despite rising prices, there isn’t enough to go round. The official story is that the shortage has been caused by unscheduled repairs at oil refineries. The real reason for those repairs is being covered up by Moscow's propaganda machine.

Russia is sliding into a fuel crisis. Long queues can be seen at petrol stations in several regions. The shortage is particularly severe in Transbaikalia and Primorsky Krai in the Far East and in temporarily occupied Crimea.

Russian officials have been trying to reassure the public by spreading their usual narratives about a "seasonal rise in demand" and "unscheduled repairs at oil refineries". In fact, the real situation is very different from the official account. The fuel shortage is largely the result of massive Ukrainian drone attacks that have struck several key refineries.

The drone strikes have caused wholesale prices to skyrocket and led to a ban on oil product exports.

A series of strikes on oil refineries

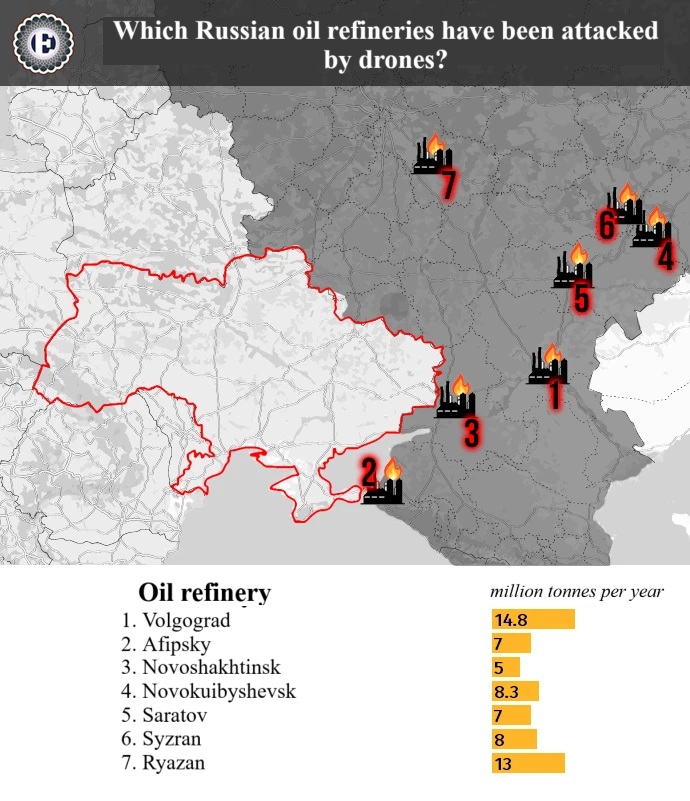

Ukrainian drones have been consistently attacking Russia's oil refining infrastructure since early August. In less than three weeks at least seven major refineries have been struck, and some have been forced to halt operations entirely. Several have been hit more than once.

The first to be targeted were the Ryazan and Novokuibyshevsk refineries. The Ryazan refinery, which processed 13.1 million tonnes of oil per year (around 5% of Russia's total refining capacity), shut down following a strike on 2 August. On the same day, the Novokuibyshevsk refinery, which used to process approximately 8.3 million tonnes per year, was also hit by drones.

Наслідки удару безпілотника по Новокуйбишевському НПЗ у Самарській області Росії pic.twitter.com/EOQhSaXExf

— Українська правда ✌️ (@ukrpravda_news) August 2, 2025

Five days later, the Afipsky refinery, which processed over 7 million tonnes of oil annually, came under attack. Shortly afterwards, the Saratov refinery suffered the same fate. Its modernised facilities had a processing capacity of 7 million tonnes per year.

On 14 August, the Volgograd refinery, one of Russia's largest with a capacity of 14.8 million tonnes per year, was forced to cease operations. The following day, drones hit the Syzran refinery, capable of processing 8-8.5 million tonnes annually. The Novoshakhtinsk refinery was the latest to be struck, on the night of 20-21 August.

In just a few weeks, Ukrainian forces have knocked out more than 50 million tonnes of annual refining capacity. That’s over 14% of Russia's total capacity.

This poses a serious challenge for the Russian economy. These aren’t just local disruptions, but a strategic loss of several pivotal components of the country's fuel sector.

Prices at historic highs

Amid these developments, wholesale petrol prices in Russia are hitting record highs. On 20 August, the price of A-92 petrol on the St Petersburg International Mercantile Exchange reached a record RUB 72,500 (roughly US$895) per tonne, while A-95 petrol climbed to RUB 82,200 (around US$1,016) per tonne. Wholesale prices for A-95 have risen by 35% since the start of summer and by over 50% since the beginning of the year, while A-92 prices have increased by 40%.

To curb the crisis, the Russian government convened an emergency meeting with oil companies, resulting in an extension of the petrol export ban. They also discussed manually regulating commodity exchange quotations: if prices rise by more than 10% in a month, they would be rolled back to the level they were at at the start of the month.

But these measures appear to be failing. Fuel is becoming scarcer at petrol stations every day, queues are getting longer, and prices continue to break previous records.

What comes next

In line with their usual approach, the Russian authorities are attempting to play down the extent of the problem, blaming it on "a rise in seasonal demand coinciding with logistical difficulties" and "unscheduled repairs at oil refineries".

However, both international and some Russian media outlets point to the strikes on oil refineries as the main cause of the crisis. Sergei Aksyonov, the Russian-installed head of temporarily occupied Crimea, has mentioned this too, saying that the market will only fully recover after the war against Ukraine is over – thereby effectively confirming the systemic nature of the problem.

July to September is always the peak period for fuel consumption in Russia, points out Serhii Kuiun, director of the A-95 Consulting Group, a Ukrainian organisation providing insights into fuel prices and supply. Minor supply disruptions used to be common at this time of year, but they have now been exacerbated by the Ukrainian attacks. "In previous years, Russia used to experience shortages during the summer season, but now Ukrainian drone strikes have intensified the problem. This is making the situation especially tense," Kuiun explained.

Kuiun said the situation going forward will depend on whether the attacks continue and how quickly the Russians can resume operations at the refineries. What is the situation there?

According to Reuters, the attacks have forced the Ryazan refinery – Russian energy giant Rosneft’s largest – to halt operations on roughly half of its capacity, while the Novokuibyshevsk refinery is not refining any crude at all. Sources told Reuters that repairs will take at least a month. The Novokuibyshevsk refinery is likely to stand idle until the end of August, while the Volgograd refinery, the largest in southern Russia, is expected to remain shut until mid-September.

These projections are based on optimistic assumptions that no further attacks will occur. If the strikes continue, the fuel market crisis will worsen, as Russia will lose even more capacity and become even less able to supply the domestic market.

It’s the general public who will be affected by the strikes on oil refineries, not the Russian military, Sergey Vakulenko, a senior fellow at the Carnegie Endowment for International Peace, told the Financial Times.

"The consumer market may face an unprecedented level of problems. A full-scale fuel supply crunch – one affecting the army, transport and agriculture, and capable of disrupting the economy – is still distant," he said.

Translation: Artem Yakymyshyn

Editing: Teresa Pearce