Drone shortages and severed links: why Ukraine still trails on fibre-optic UAV production

In January, in an interview with Ukrainian media outlet LB, Oleksandr Syrskyi, Ukraine's Commander-in-Chief, said Russia and Ukraine use roughly the same number of drones on the front line, but that Ukraine is only "catching up" in terms of fibre-optic FPV systems, which are largely immune to electronic warfare.

Russia's large-scale adoption of the technology in 2024 took Ukraine by surprise. To narrow the gap, the state has begun backing domestic developers.

Output has risen sharply over the past year. New models have entered service and operating ranges have increased. Despite this, troops continue to report shortages and quality problems.

"Our vehicle made three or four runs under fire to deliver drones and they turned out to be defective", the commander of the Panama Squad crew from the 1st Separate Territorial Defence Brigade, whose call sign is Mukha (Fly), told Ukrainska Pravda. "We hauled them out, swearing, taking risks, to come back with working ones and it's good it ended without losses. But it would be unbelievably stupid to lose a vehicle and, God forbid, people because someone totally f***ed up their responsibility." The battlefield value of such drones is only growing. In a fight saturated with electronic warfare, the ability to reach a target with near certainty without losing connection is worth its weight in gold.

So why does Ukraine still struggle to produce fibre-optic FPV drones at scale and to a consistent standard? To find out, Ukrainska Pravda spoke to service personnel and manufacturers.

Shortages and quality issues

Serhii Melnyk, head of the information and analytical support section at the 69th centre, said fibre-optic drones make up no more than 15% of all drones along the entire line of contact.

That percentage is far from uniform across the front line. The proportion of fibre-optic FPV systems varies sharply depending on the intensity and character of fighting and on how well individual units are supplied.

Russian forces have made particular gains in this niche. "It feels as if the Russians have already reduced analogue communications by about 60% and have almost completely switched to fibre optics", said a fibre-optic FPV crew pilot, Maloi (Kiddo).

A frequently cited example is the Russian fibre-optic drone Knyaz Vandal. Fitted with day and night cameras, it can operate at ranges of up to 40 km and is often used as a "sitter" for ambushes. Its manufacturer claims Russia produces as many as 50,000 units a month.

And where does Ukraine stand? Summing up his tenure, Ukraine's former defence minister Denys Shmyhal said 352,000 fibre-optic FPV drones had been delivered to the armed forces since July 2025. The figure excludes drones supplied by volunteers or obtained through the E-baly (E-points) scheme, a digital incentive system that awards units points for verified destruction of Russian targets, which can then be exchanged for equipment such as drones, electronic warfare systems and ground robots.

Ihor "Enei" (Aeneas) Raikov, head of the unmanned systems service of the 13th brigade of the Khartiia National Guard unit said that the state currently meets up to about a third of unit demand for fibre-optic drones through direct supply. The remainder, he said, comes DOT-Chain and Brave1 Market (a government-subsidised digital marketplace for units to purchase the equipment they need directly from manufacturers), the unit's budget or soldiers' own money.

In most units, the typical operating range for fibre-optic FPV drones is 15 to 25km, though some teams work at significantly longer distances. "We have gone from 10 to 25km and we are now mastering distances of 400-50 kilometres", said Enei.

Despite higher supplies and longer operating ranges than at the start of a difficult 2025, drone availability along the front remains patchy.

Some servicemen interviewed by Ukrainska Pravda say there is still a shortage of fibre-optic drones that can work reliably at the now standard distances of 15-20 km.

"Fibre optics are critically important right now and there are not nearly enough of them. In contrast, Russian supply looks much better", says Maksym Buhel, commander of the Boryviter unmanned systems battalion of the 95th Separate Air Assault Brigade.

Quantity is only part of the problem. Quality also remains a major sticking point. Troops report issues with spools, their awkward form and components that are not fit for combat. In practice, the standard of drones received often depends on how much money a unit can raise or allocate.

"Despite the large number of manufacturers and offers, there are few truly reliable fibre-optic drones on the market and there is always a queue for them", says Mukha, commander of the Panama Squad crew.

He said that quick-to-buy options often perform erratically. As a result, quality varies sharply from one batch to the next.

Why do quality problems occur?

From an engineering standpoint, a fibre-optic FPV drone differs little from a radio-controlled one.

"Producing fibre-optic drones is, in a sense, simpler than radio equivalents. They do not have radio communication modules, antennas and VTX," says Volodymyr Zinovskyi, CEO of drone manufacturer TAF Industries.

Instead of radio communication modules, the drone is fitted with a fibre-optic spool and a media converter, which are directly connected to the operator's control unit.

However, the devil is in the details. As one manufacturer of fibre-optic spools, who asked to remain anonymous, explains, the main challenge lies in the fibre itself. Unlike industrial fibre in a silicone sheath (the kind we see in internet cables), drones use "bare fibre". As a result, the most difficult stage of production is winding the spool.

"If you kink it, wind it unevenly or overtighten the fibre on the reel – that's it, you're done", the manufacturer told Oboronka.

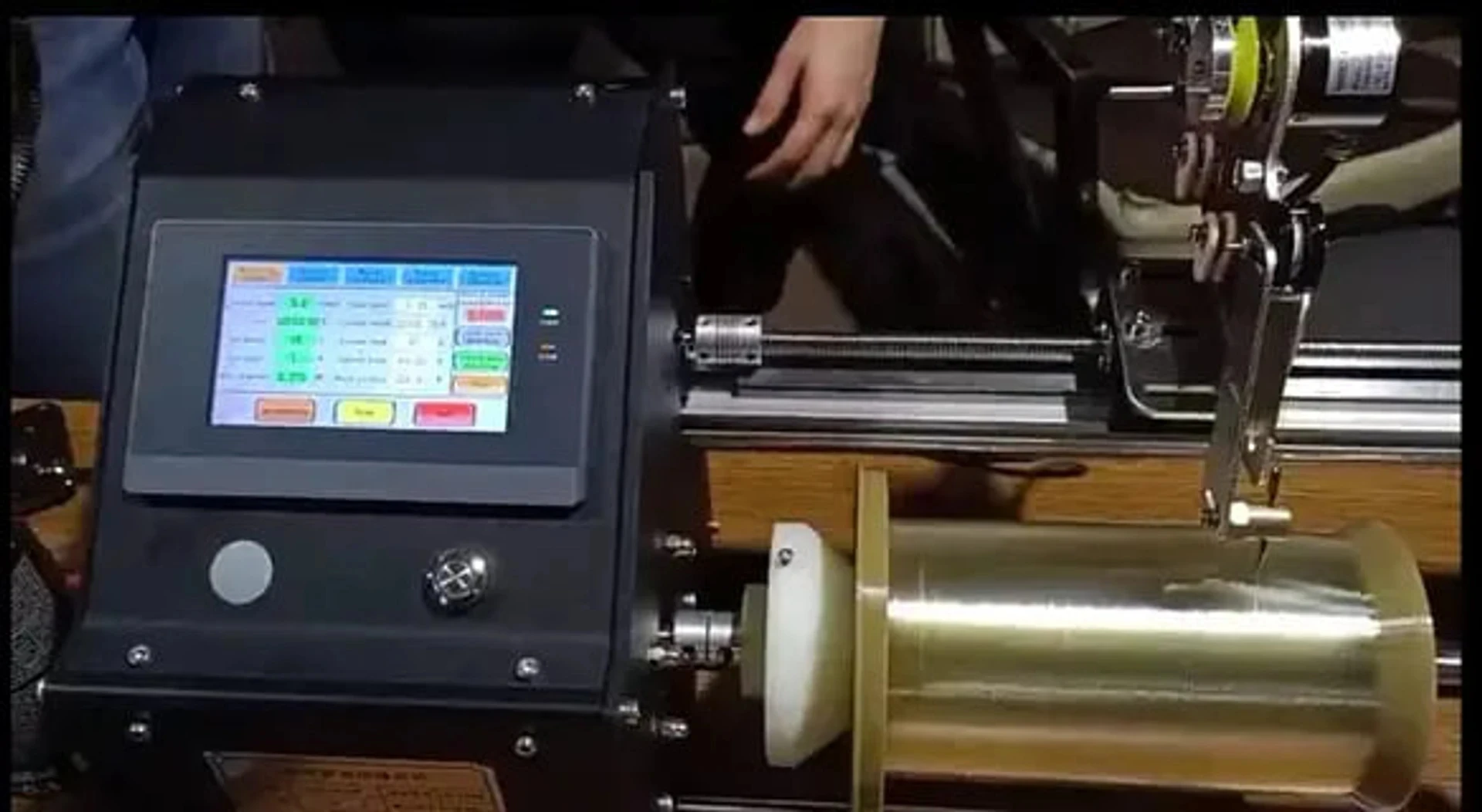

Unlike Russia, which orders pre-wound spools from China and adapts its own platforms to them, Ukraine has been forced to master the winding technology virtually from scratch.

According to the source, most winding machines in Ukraine are homemade. Each manufacturer effectively creates its own standard, which constantly changes as new drone models appear, requiring the frequent recalibration of equipment.

Another factor affecting production speed and quality, highlighted by two manufacturers interviewed, is power and heating outages. The equipment and some materials are sensitive to these disruptions. Even a momentary power cut – if a company has not properly implemented autonomous backup systems – can result in an entire batch being rejected.

"It's easier for the Chinese. They have many machines, each tailored to a specific model. That's where their stable mass production and quality come from", another spool manufacturer told Oboronka on condition of anonymity.

In addition to mastering spool production, Ukrainian companies also had to adapt the drones themselves to changes in weight and centre of gravity caused by installing a spool weighing more than a kilogram. As drone manufacturer Heneral Chereshnia ("General Cherry") explained to Oboronka, fibre-optic drones are significantly more complex than standard FPV drones. The integration of the spool requires precise balancing of weight, thrust, power consumption and the drone's behaviour during an attack.

These solutions required financial and technological resources that not all manufacturers could afford. As a result, the market initially split into companies producing drones and spools separately and those producing both. This division led to chaos in supply chains.

"Spools, drones and ground stations were supplied separately, so everything had to be assembled by hand", said Aeneas. "We glued, soldered and improvised, but a large number of them crashed for no obvious reason."

Manufacturers managed to streamline production processes and logistics over time, making it possible to deliver fully integrated drone systems to the troops. Stabilised production allowed further development of fibre-optic drones, gradually expanding the operational capabilities of Ukraine's defence forces.

Meanwhile, according to soldiers interviewed by Oboronka, problems with fibre deployment during flight are still an issue. One manufacturer says the only solution is strict quality control, both during production and immediately before use.

Can Ukraine catch up with Russia in fibre-optic drones?

In addition to fibre deployment issues, soldiers interviewed by Oboronka increasingly point to the lack of standardisation in ground control stations. Manufacturers design their own ground stations for specific drones, which are often incompatible with one another. As a result, units are forced to operate multiple control systems for different drones, complicating logistics and operation.

Defence Minister Mykhailo Fedorov said that more than 30 companies in Ukraine were producing fibre-optic drones as of July 2025, although the real number may be higher. Standardising drones and ground stations would reduce the logistical burden and lower procurement costs when sourcing systems from different manufacturers.

Overall, further development of fibre-optic drones will directly depend on real battlefield conditions. As both soldiers and manufacturers note, not every solution that looks impressive at exhibitions or presentations proves effective in combat.

"I'd divide the market right now by two criteria: how it looks and how it works", said one manufacturer. "Sometimes a drone looks like a doll but can't fly for shit. Other times it looks like a scarecrow but works brilliantly. And there aren't many of those who manage both."

Despite this, all manufacturers interviewed expect further growth in fibre-optic drone procurement. Around 70% of state drone purchases are planned to go through the DOT-Chain Defence system in 2026. This system will not only allow the military to order drones directly from manufacturers, but will also create conditions in which competition highlights the most effective solutions.

Manufacturers are already looking for ways to adapt to the new market rules, seeking to combine increased production capacity with improved stability and reliability.

Heneral Chereshnia representatives say the military's key demands are predictable quality, stable supply and systematic drone integration. Zinovskyi from TAF predicts an increase in flight range and procurement volumes. The company is preparing to fulfil orders for tens of thousands of drones per month, with the potential to scale up to 100,000 units.

At Ptashka Drones, meanwhile, launching pilot training programmes is being considered as one way to reduce the number of drone losses during combat operations.

Another trend expected by the soldiers interviewed is increased flight range without adding weight. Some Ukrainian manufacturers are already working on reducing the weight of fibre-optic spools, allowing drones to carry larger warheads or more powerful batteries. Similar frameless spools have been spotted in China.

"We're essentially going through the same path the Chinese have already taken", one manufacturer concludes. "The potential is there and what we need now is time and experience."

Author: Illia Volynskyi, Oboronka (Ukrainska Pravda)

Translation: Ganna Bryedova and Tetiana Buchkovska

Editing: Shoël Stadlen