US$20 billion for Putin. Why Western countries hesitate to impose sanctions on Russian metals and diamonds

Diamonds in a bloody setting. Why does the West hesitate to impose sanctions on metals and gemstones from Russia?

European Union countries have banned or restricted imports of Russian oil and oil products, coal and natural gas over the past year. These are the core but by no means the only sources of the Kremlin's income.

Apart from the rather sensitive issues of grain and fertiliser sales, some Russian goods are not usually mentioned in sanctions packages. These are metals and gemstones.

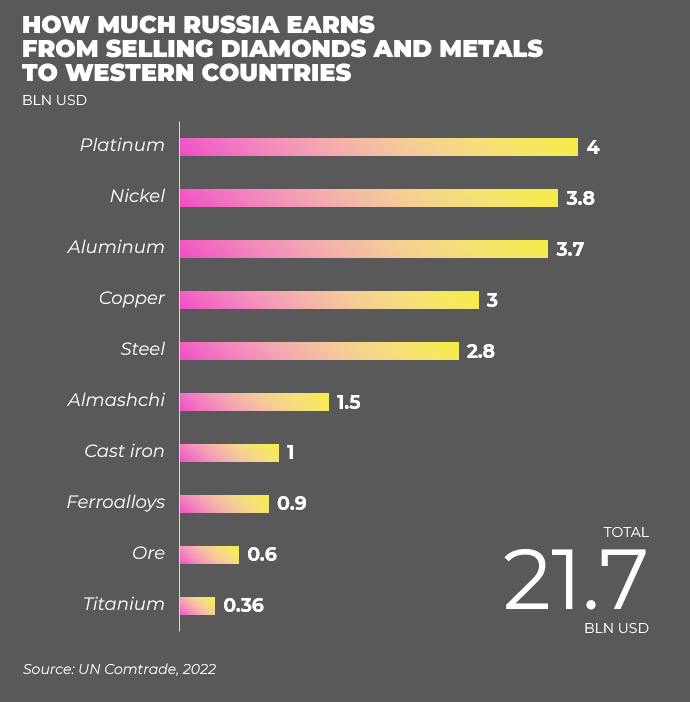

The Ekonomichna Pravda estimates that exports of these two products to Western countries still bring the aggressor country an additional US$20 billion annually.

These revenues are scattered across a dozen different types of metals and precious stones, but Russian companies use these crumbs to raise tens of billions of dollars to finance the war in Ukraine.

Diamonds for Belgium

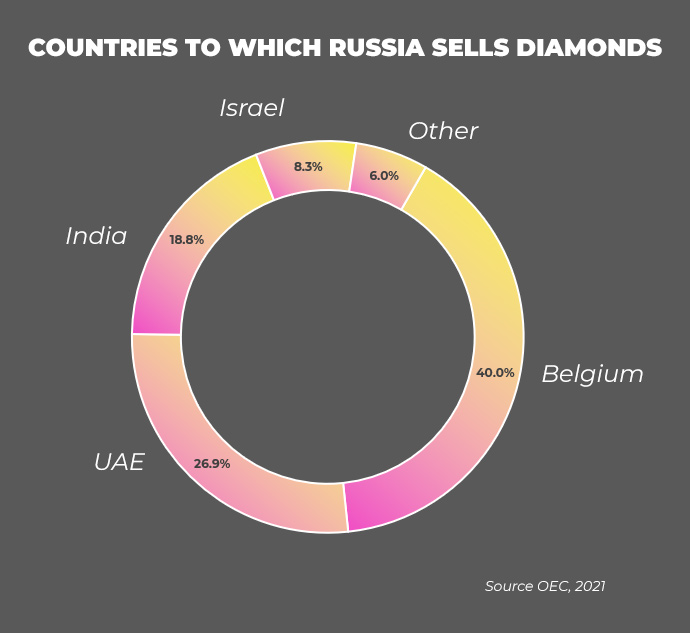

UN Comtrade estimates that Russia supplied nearly US$1.5 billion worth of diamonds to the Western market in 2022. 95% of this volume ended up with buyers from Belgium, as Antwerp is home to the world's largest diamond hub. The famous diamond district of this city sees gemstones from all over the world.

However, not all diamonds in Belgium are of Russian origin. The aggressor country accounts for only 25% of gem supplies, but the EU has not yet imposed any restrictions on the procurement of this product.

Representatives of the diamond industry in Antwerp oppose the sanctions, as the ban on Russian gems will allegedly lead to the bankruptcy of small traders and the loss of 10,000 jobs.

Addressing the Belgian parliament in 2022, President Volodymyr Zelenskyy tried to convince local authorities that "peace is worth more than any diamonds". The Belgian government stressed that it wasn’t blocking the embargo, but the country managed to avoid measures against Russian diamonds in each sanctions package.

The Belgian money from the sale of diamonds goes to the Russian government-owned Alrosa PJSC. The group is one of the large "wallets" from which the Kremlin fuels the war against Ukraine.

Alrosa has avoided Western sanctions so far. Canada, Australia, New Zealand, the United States, the United Kingdom and Japan have imposed restrictions only on the company's management. Meanwhile, the EU and Switzerland seem in no hurry to impose even personal sanctions against the company’s executives.

Previously, Alrosa paid taxes for the use of its deposits to the budget of its region [the Republic of Sakha, Federal Subject of the Russian Federation, located in the country’s Far East – ed.], but in 2023, Russia’s State Duma [lower chamber of the Russian parliament – ed.] raised them and ordered to charge 50% to cover the federal budget deficit.

In addition to using Alrosa's resources for the war effort, the group supports the maintenance of the submarine that bears its name. The Alrosa diesel-electric submarine is part of the Russian Black Sea Fleet and features Kalibr cruise missiles.

Alrosa is not only a financial source but also a geopolitical tool for Putin's conquest of Africa. The group has diamond mines in Angola, Zimbabwe, and the Democratic Republic of Congo. It also targets the Central African Republic, where Russian mercenaries from the Wagner Private Military Company have been operating. Along with Russian investment in these countries comes an influence on local politicians.

Nevertheless, Belgium continues to pump money into Alrosa. The country reduced imports of Russian diamonds last year, but only by a quarter.

Antwerp is worried that if an embargo is imposed, Russia will redirect their diamonds to competitor hubs in India, the UAE and Israel.

"If Belgium does agree to sanctions, it will want to coordinate the embargo against Russian diamonds with other Western countries. The plan is to create a system to track the origin of diamonds and ban countries from buying diamonds made from Russian commodities.

Then Indian and Arab hubs will not be able to make money on the sale of toxic Russian diamonds, and Belgium will benefit from the sale of "proper" diamonds," Svitlana Taran, an analyst at the Kyiv School of Economics, told EP.

The Financial Times reported that Belgium allegedly agreed to impose sanctions, but as Ukrainian representatives stated, the final decision has not yet been made.

"The draft of the 11th package of sanctions, which was presented on 9 May, does not contain a single word about the diamond embargo," said a source familiar with the following package of sanctions against Russia.

Whilst Belgium and the European Union negotiate, Russia is gaining time to develop its markets in India and the UAE. Every day of delay makes a potential embargo lose its impact.

Platinum for Western vehicle manufacturers

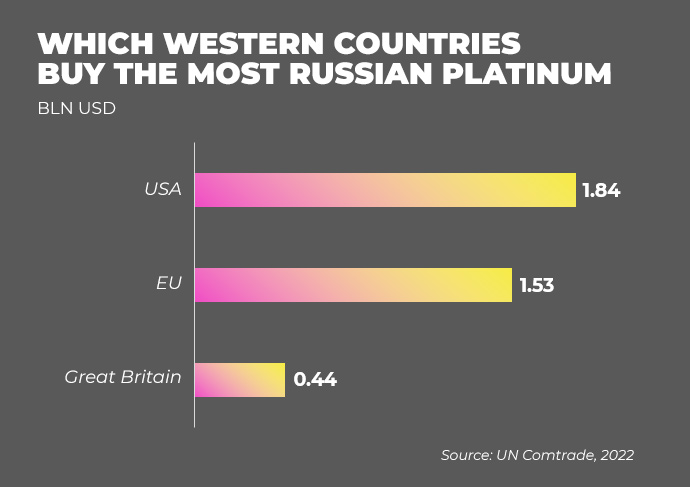

Russia also offers platinum group metals. Their exports to Western countries brought the country US$3.8 billion in 2022. In contrast to diamonds, there is no discussion of an embargo on them at all.

For reference: The platinum group metals include ruthenium, rhodium, palladium, osmium, iridium and platinum. They are mainly used in the automotive industry.

Platinum and palladium sales bring in the most revenue for Russians. The main importers in the West are the US, the UK, Germany and Italy.

Russian Platinum and Norilsk Nickel are two Russian companies, the major profit earners. The latter is one of the favourite "toys" of Putin's oligarchs.

Norilsk Nickel is controlled by Vladimir Potanin, Russia's second-richest man. The company is one of Russia's five largest taxpayers, and Potanin himself is an oligarch close to Putin. The second major shareholder in Norilsk Nickel is United Company RUSAL, belonging to oligarch Oleg Deripaska, one of the wealthiest people in Russia. It has been implicated in scandals involving Russian interference in the US election.

Both oligarchs are currently under personal sanctions from many countries, but each owns less than 50% of Norilsk Nickel, so these sanctions do not apply to the company itself.

The EU, Switzerland and Japan have not yet imposed personal sanctions against Potanin. The latter also does not impose restrictions on Deripaska.

The sanctions may shake Norilsk Nickel. According to EP's sources in the company, the group faced a shortage of Austrian equipment in 2022. This forces its management to look for alternative equipment suppliers of "questionable quality", which cost 70% more.

"Safe harbours" for blood money. Why are Russia's assets not being seized in the West?

The air travel ban and the growth of the Russian rouble have hit the supply chain and forced the company to seek additional working capital. Norilsk Nickel may cut platinum production by 1-7% and palladium by 7-14% in 2023. The company's Board of Directors recommended that shareholders not pay dividends for 2022 for the first time in 15 years.

However, the Russian steel giant seems to have avoided a catastrophe. The company is gradually shifting its focus to China and continues to generate revenue in Western markets, financing the federal budget.

The only countries that have taken steps to reduce Russian platinum revenues so far are the United States and the United Kingdom. These countries have imposed additional duties but have not set an embargo.

Non-ferrous metals for the EU

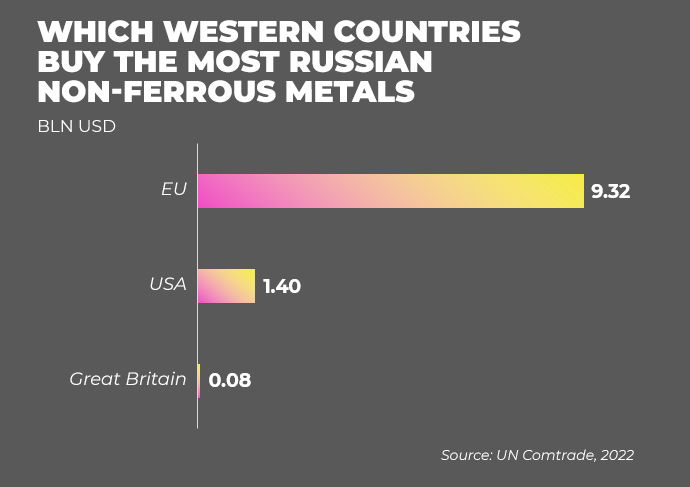

Exports of aluminium and copper to Western countries brought Russia US$6.7 billion. Almost all of the metal was exported to the European Union. The largest beneficiaries are the same, particularly Rusal, Norilsk Nickel, and Ural Mining and Metallurgical Company (UMMC), whose owner, Andrey Kozitsyn, is a member of Putin’s United Russia political faction.

These metals are used in the production of electric vehicles, so demand for them is steadily growing.

The European Union is still procuring copper and aluminium from the aggressor country, although it is not heavily dependent on it. Imports from Russia account for only 8% and 17% respectively.

At the same time, Russia sends a quarter of its aluminium and about a third of its copper to the EU. So, a potential embargo would hit Russia harder than the EU.

However, the only significant dependence is on Russian nickel, making up almost half of the EU's imports and US$3.8 billion of the aggressor's revenue. Most of this metal is bought by Finland, where Norilsk Nickel has built Nornickel Harjavalta, a subsidiary processing facility.

Titanium for the USA and Germany

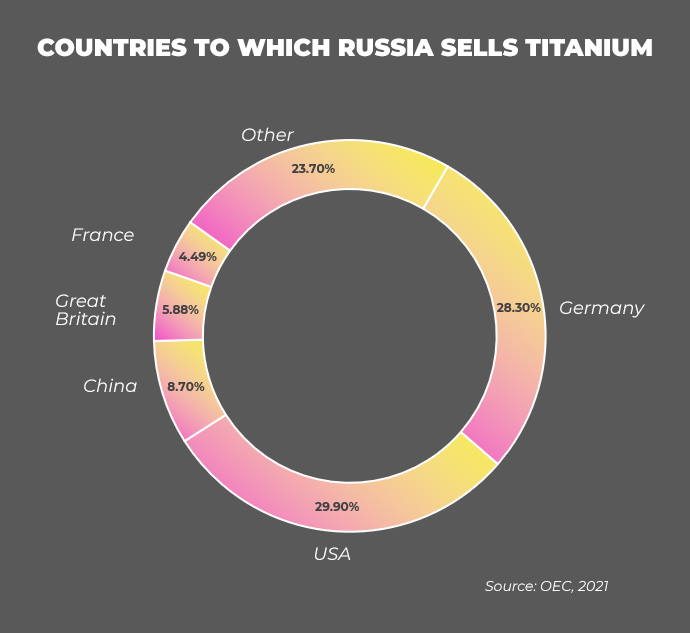

Western countries bought US$365 million worth of Russian titanium in 2022. Aircraft manufacturers Airbus and Boeing purchased the majority of the volume for their plants in the US and Germany.

VSMPO-AVISMA Corporation, which receives Western money from selling titanium, serves the Russian military industry. It supplies titanium to produce armoured vehicles, combat aircraft and missiles.

VSMPO-AVISMA’s facilities are strategic for the Russian military-industrial complex, so the company should have been sanctioned as an arms manufacturer. However, so far, only Ukraine has done so.

In 2022, Russian titanium was pulled off the sanctions list at the last minute, as the countries that manufacture Airbus aircraft wanted it so.

The US Boeing has abandoned the Russian titan. Airbus intends to do the same. To this end, the European airline giant and its partners have acquired French titanium supplier Aubert & Duval. However, the ban has not yet been imposed at the country level, so exports continue.

Steel and iron for everyone

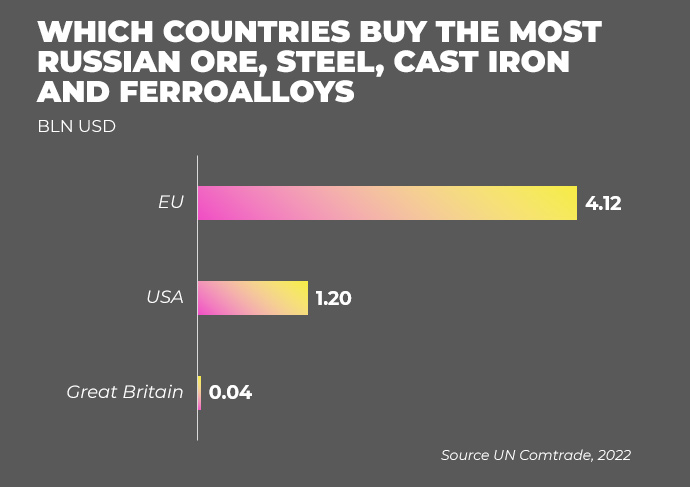

The Russian ferrous metallurgy industry has been repeatedly included in sanctions packages, but Western countries have not been able to completely abandon Russian iron, steel, ore and ferroalloys. Russia’s exports of these products to the West amounted to US$5.3 billion in 2022.

The largest pig iron producer in Russia is Novolipetsk Metallurgical Plant (NMP), owned by oligarch Vladimir Lisin. In December 2022, journalists of the Times discovered that Lisin's company supplied steel for Russian nuclear weapons.

Nevertheless, Lisin and his company have not yet been subject to Western sanctions, and Russian pig iron and ferroalloys have remained outside the embargo. They account for 28% and 4% of EU imports, respectively.

Only Ukraine and Australia have imposed sanctions on Vladimir Lisin so far.

The European Union has reduced its imports of Russian iron ore by four times but still purchases it. The EU paid US$600 million to Russia in 2022 alone. At the same time, the share of Russian ore in EU imports is insignificant – only a few percent.

The eighth package of EU sanctions imposed an embargo on the import of Russian ferrous metals, but it will only take effect from 30 September 2023 and for some items from 2024.

The decline in steel production in Russia in 2022 did not meet the expectations of the countries that imposed sanctions. GMK Center stated that the Worldsteel Association expected a 20% drop in April 2022, but the decline was only 7%.

Time matters

Critics of tougher sanctions argue that Russia is shifting its goods to Asia and will still make money anyway. Svitlana Taran believes that India and China will not wholly replace the vast and logistically close market of the G7 countries, so this excuse is misleading.

Sanctions remain a highly effective tool if they are imposed without exception.

The timing of the embargo also matters. The longer the embargo is delayed, the more time Russia has to partially shift its products to Asian markets. Revenues from Western countries also allow Russians to finance the "war budget" during the hottest war period.

The Russian extractive and processing industry has been increasing production of certain goods despite the sanctions pressure, said Lidiia Lisovska, an analyst of the ANTS project Russian Assets as a Source of Economic Recovery in Ukraine.

Russia's production of stainless-steel ingots in the first quarter of 2023 was 132.6% up on the same period in 2022. Production of lead concentrates, alloy steel ingots, powdered silver, aluminium wire, unprocessed titanium, zinc and magnesium increased considerably.

Ukraine can also encourage the West to impose an embargo on Russian metals and gemstones by offering its goods to the European market. First of all, uranium, titanium, ore and ferroalloys, Ostap Semerak, former Minister of Ecology and Natural Resources of Ukraine, told EP.

"If Ukraine is included in strategically important production chains, it may make the Germans and the French care more about our protection. To do this, government officials should offer specific investment projects. Investors will not come in on their own," he said.

The EU managed to quickly abandon most of the Russian gas in 2022 thanks to the rapid mobilisation of resources and investment in infrastructure, although its dependence on it was 40%.

The same "miracle" can be achieved with a number of other non-sanctioned goods if Ukraine’s allies pay due attention.

"So far, we do not see our partners' commitment to fully sanction Russian diamonds, platinum, non-ferrous metals and ferrous metallurgy. These are billions of dollars of revenue that Russia uses to create weapons. To cut off these flows, we need joint decisive actions, not delays or exceptions," Vladyslav Vlasiuk, advisor to the Ukrainian President’s Office, told the EP.

The story was created within the framework of the ANTS project "Russian Assets as a Source of Recovery of the Ukrainian Economy", implemented in cooperation with the National Democratic Institute (NDI) with the financial support of the National Endowment for Democracy (NED).

Bohdan Miroshnychenko for Ekonomichna Pravda

Translation: Аrtem Yakymyshyn